Stocks rebounded in a volatile session marked by geopolitical headlines, with Nvidia Corp. climbing ahead of its results. Bitcoin extended its post-election rally.

Trading in options signals Nvidia’s results Wednesday will be the most-important catalyst left this year — more than the Federal Reserve’s December meeting, according to Barclays Plc strategists. The chipmaker at the forefront of the artificial-intelligence boom rose 4.9%, leading gains in the S&P 500. An earlier slide in equities was driven by Ukraine’s first strike with US missiles in Russia and President Vladimir Putin’s approval of an updated nuclear doctrine.

To Gaurav Mallik at Pallas Capital Advisors, geopolitical uncertainties are indeed a recipe for volatility. As for Nvidia’s results, he’s expecting strong numbers, citing capital expenditure by big tech and his view that there’s still “no clear substitute” for the company’s chips.

“This market is fickle,” said Nancy Tengler at Laffer Tengler Investments. “Stocks ultimately trade on earnings and they have been great. I don’t recommend stocks ahead of earnings, but if NVDA sells off, jump in.”

The S&P 500 added 0.4%. The Nasdaq 100 climbed 0.7%. A gauge of the “Magnificent Seven” megacaps advanced 1.7%. The Dow Jones Industrial Average slipped 0.3%.

US 10-year yields slid two basis points to 4.39%. Oil and gold rose.

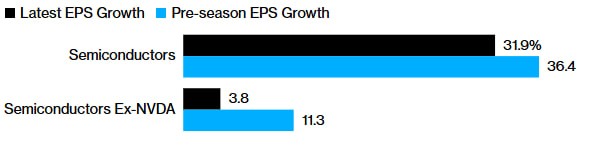

Earnings Growth Gap

Excluding Nvidia, chip stocks saw their third-quarter earnings projections fall