2025/02/02

‘Complete Betrayal’: Canada Reels as Trump Tariff Rattles Major Trading Relationship

Trudeau readies counter-levies on steel, aluminum, cars. Government says US should partner with Canada, not punish it

More⋯

2025/01/26

Trump Boosts Tether, Circle by Tying Stablecoins to Dollar

US crypto czar sees potential for extending dollar dominance. USDT, USDC account for almost 90% of total stablecoin value

More⋯

2025/01/21

Stocks Rally on Tariff Delay in Market Mesmerized by Trump

Eliminating electric vehicle subsidies hits Musk’s Tesla. Shares with tariff risks largely shrug off Trump’s threats

More⋯

2025/01/11

US Inflation Is Set to Back Fed Pause After Robust Jobs Data

Progress toward tamer price pressures has essentially stalled. Inflation will keep UK in market focus; China, German GDP due

More⋯

2025/01/08

Zuckerberg Pivots Harder Toward Trump as Political Winds Shift

Meta CEO accused fact checkers of bias and destroying trust. Facebook and Instagram continue fact-checking outside US

More⋯

2025/01/05

Is the Stock Market’s ‘January Effect’ Real?

For decades, a popular theory has held that US stocks tend to rise more in January than in other months.

More⋯

2025/01/03

BlackRock’s Bitcoin Fund Became ‘Greatest Launch in ETF History’

IBIT has grown to more than $50 billion in assets in 11 months. US ETFs played a key role in Bitcoin’s rally over $100,000

More⋯

2024/12/31

Nvidia Closes Acquisition of Israeli Software Startup Run:ai

Software works on Nvidia-based systems, to be open-sourced. Value of deal pegged at $700 million by Calcalist in April

More⋯

2024/12/29

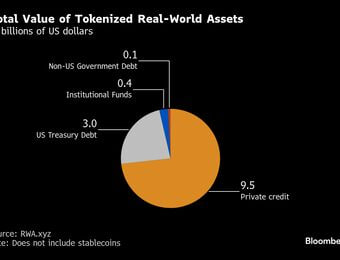

Tokenization Has Become Wall Street’s Latest Favorite Crypto Buzzword

‘It may even be bigger than the internet,’ proponent says. BlackRock, Trump’s election win have re-energized efforts

More⋯

2024/12/27

"New Fed News Agency": The Fed is trying to assess Trump's influence

Powell's headache is how to deal with the inflationary pressure that Trump's policies may bring without openly rebelling against him. Will he compromise with Trump like he did in 2018? This time may be different.

More⋯

2024/12/20

Powell’s Battle-Ready Fed Gives the Trump Trade a Stress Test

Inflation focus upends rate-cut calculus, dents market returns. ‘Tug and pull’ between conflicting forces promises more swings

More⋯

2024/12/18

MicroStrategy’s Saylor Wants More ‘Intelligent Leverage’

Firm will likely revise capital raising plan once limit is met. Regulated US exchanges like Coinbase used to buy Bitcoin

More⋯

2024/12/11

Big news! Google's Willow quantum chip is born: solving the 30-year problem of quantum computing, Musk is amazed, Altman congratulates

Google's new quantum chip Willow solved in 5 minutes what would take supercomputers 10²⁵ years, showcasing its error reduction and superior performance

More⋯

2024/12/09

US Bitcoin ETF Inflows Near $10 Billion Since Trump Election Win

Expectations that crypto will thrive under Trump spur demand. Bitcoin has posted its longest weekly winning run since 2021

More⋯

2024/12/05

The Dow fell on non-farm payrolls day, the S&P and Nasdaq hit new highs, Chinese stocks rose 2% at one point, the US dollar rebounded V-shaped, and Bitcoin returned to $100,000

The Dow Jones Industrial Average fell for two consecutive days and turned down for the whole week. The S&P rose about 1% for the week and rose for three consecutive weeks. The Nasdaq rose more than 3%. Tesla rose more than 5%. Amazon and Meta hit new highs. Nvidia fell 1.8%. The increase in non-farm payrolls in the United States in November exceeded expectations, but the unemployment rate rose slightly. The market moderated and bet on interest rate cuts. Many voting committee members supported slowing down interest rate cuts next year. The yield on two-year U.S. Treasury bonds fell by about 5 basis points. Both the U.S. dollar and gold fell first and then rose. The U.S. dollar turned up during the week. The euro fell after hitting a three-week high. French stocks rose 2.7% for the week. The offshore renminbi fell below 7.28 yuan and fell for five consecutive weeks. The yen rose above 150 again, and the Korean won fell 1.8% for the week. Oil prices fell by about $1 on Friday and fell by more than 1% for the week.

More⋯

2024/11/30

Cathie Wood Welcomes Looser Regulation Heralded by Trump Return

Ark Invest founder approves of tariffs if offset by tax cuts . Wood sees broader gains in stock market under new regime

More⋯

2024/11/25

Secretary Bessant, what does this mean for U.S. taxes, interest rates, and U.S. debt?

Analysts said that in terms of tax policy, attention should be paid to Bessant's speech at the hearing; Bessant has little impact on interest rates, and the key is to what extent the White House can use Bessant's reputation to prevent bond market fluctuations. Bessant may adopt "unconventional" measures to solve the U.S. debt ceiling issue. In addition, he will also play an important role in cryptocurrency regulation.

More⋯

2024/11/28

US Bitcoin ETFs Head for Record Monthly Inflow on Trump Optimism

The 12 funds have wooed a net $6.2 billion so far in November. Bitcoin came close to $100,000 on Trump’s pro-crypto agenda

More⋯