Stocks fell and bond yields rose, with traders keeping a close eye on Jerome Powell’s testimony before Congress after he reiterated the Federal Reserve is in no rush to cut rates.

“With our policy stance now significantly less restrictive than it had been and the economy remaining strong, we do not need to be in a hurry to adjust our policy stance,” Powell said in remarks prepared for testimony Tuesday before the Senate Banking committee.

Jerome Powell.

Equities pushed lower as weakness in most big techs weighed on trading. Meta Platforms Inc. lost traction after notching a 16-day winning streak. Coca-Cola Co. rallied as profit beat expectations. Long-maturity Treasury yields rose more than the rest of the US curve, with those on the 10-year bonds hovering around 4.5%. A gauge of the dollar held steady after two days of gains.

Just a day ahead of a key reading on inflation, the Fed chair is facing a tough set of hearings on Capitol Hill, with lawmakers likely to prod him on President Donald Trump’s proposals on trade, taxation, immigration and regulation. Powell is testifying before the Senate Banking Committee Tuesday, and before the House Financial Services Committee on Wednesday.

The S&P 500 fell 0.2%. The Nasdaq 100 slid 0.1%. The Dow Jones Industrial Average dropped 0.2%.

The yield on 10-year Treasuries advanced four basis points to 4.54%. The Bloomberg Dollar Spot Index fell 0.1%.

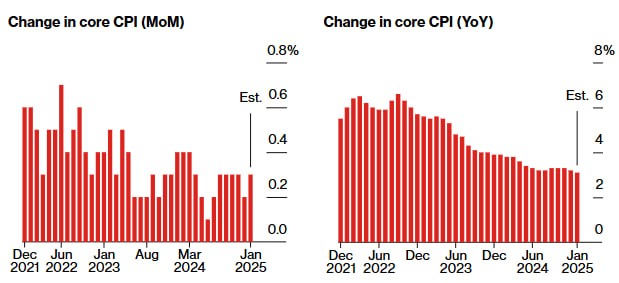

US Inflation Has Proven Stubborn

January consumer price index seen rising 0.3% for fifth time in six months

US inflation showed scant signs of downward momentum at the start of the year, while healthy job growth undergirded the economy, backing the Fed’s stance to hold the line on interest rates for now.

Bureau of Labor Statistics figures due on Wednesday, shortly before the second half of Powell’s two-day testimony marathon, are forecast to show the consumer price index excluding food and energy rose 0.3% in January for the fifth time in the last six months.

Compared with a year earlier, core CPI is forecast to have risen 3.1%. While marginally lower than than the annual figure for December, that’s just a 0.2 percentage point decline from the middle of last year.

“With the labor market remaining strong and inflation still slightly above the Fed’s target, it’s not surprising that traders are pushing out prospects of another interest rate cut from the Fed toward the middle of the year,” said Matthew Weller at Forex.com and City Index.

Weller bets the volatility around this week’s inflation reading may be more limited than in the past, as the Fed will, in all likelihood, still get another handful of inflation and jobs reports before making any additional changes to interest rates.

“That said, a pickup in price pressures could lead traders to start asking whether the Fed’s interest rate cutting cycle may be completed already, complicating the path forward for a central bank that has clearly been hinting that the easing cycle isn’t done yet,” he noted.