The Cboe Volatility Index rose above 26 intraday last week, a level rarely seen since the Covid era of 2020-2022.

Options traders who thrive on volatility are loving the market turbulence sparked by President Donald Trump’s trade fights.

As stocks ground higher in 2024, Kris McConnell used to wake up at 3 a.m. to make money off higher volatility during overnight sessions. But with the market swinging wildly this year, the 56-year-old Las Vegas-based day trader is raking in 80% more than he did last year. Plus, now he can hit the snooze button on his alarm clock.

“Anytime the VIX spikes above 20, I think to myself ‘Yes! I get to sleep in today!’” said McConnell, a trader member at proprietary firm Bright Trading. “The more outlandish Trump is, the better it is for volatility and all my trades.”

A far larger cohort of longer-term investors are feeling more pain. Most people’s 401(k)s and retirement savings took a hit the past two weeks after Trump’s tariff spat with Canada, Mexico and China wiped out more than 6% of the S&P 500 Index’s market value. But specialized volatility traders benefit from the policy moves of the Trump administration that are whipsawing the market.

“This is now a trader’s market,” said Daniel Kirsch, head of options at Piper Sandler.

That’s because those who trade on volatility are getting more opportunities to monetize their positions through hedging and options as stock correlations pick up steam, Kirsch said.

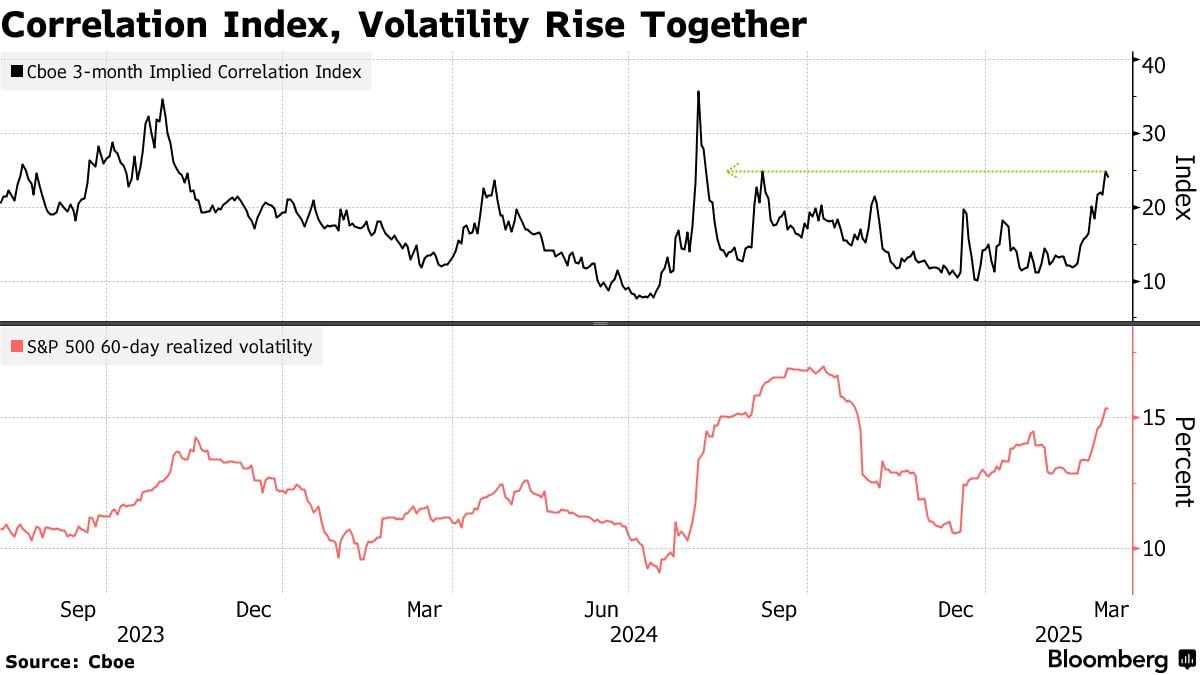

Large-scale macro risks, like Trump’s tariffs, can often make stocks move more in unison, like they do now. An index of equity correlation last week touched its highest level since the unwinding of the yen carry trade rattled markets in early August, after hovering near historic lows coming into 2025.

The increase in correlation has come with higher volatility, with the Cboe Volatility Index — which measures expectations for S&P 500 swings over the next month — rising above 26 intraday last week, a level rarely seen since the Covid era of 2020-2022. And rather than retreating in the face of market stress, day traders appear to be welcoming the volatility. Zero-day to expiry options volume reached a record 56% of overall S&P 500 trading in February, according to Cboe Global Markets Inc.

“We haven’t seen this much activity since the beginning of Covid,” said John Bartleman, chief executive officer of TradeStation Group Inc., an online brokerage that caters to day traders. Clients are betting more on movements in the most volatile single-name stocks and shifting away from broad-based ETFs, with options volume increasing in companies including Nvidia Corp., Tesla Inc. and MicroStrategy, he added.

While the VIX is higher, it hasn’t spiked or reached levels signaling outright panic, and market watchers are describing the recent selloff as “orderly” compared with August. A wave of hedging in January and February left investors somewhat protected against the downturn, limiting the need to pay up. Now, some of those positions have been rolled forward in anticipation of further volatility into the spring.

And although short-term implied volatility on the S&P 500 has jumped and the put skew has widened, it’s been balanced by the wider swings in the index during each session.

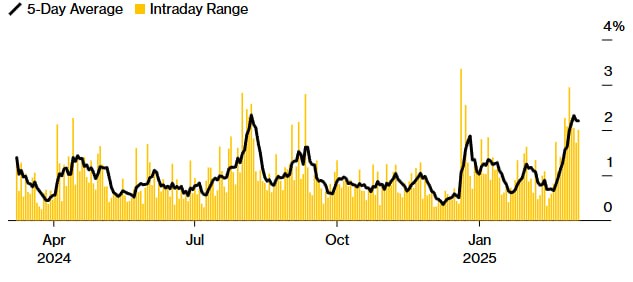

S&P 500 Intraday Volatility is Elevated

Swings in the benchmark are the largest since August

According to Christopher Jacobson, co-head of derivatives strategy at trading firm Susquehanna International Group, the options market has consistently underpriced intraday volatility for the past week.

The average move during the trading day over the past five sessions has been a round trip of around 2.2%, the most since early August, Jacobson wrote Friday in a note. And given the recent close-to-close and intraday moves, there could actually be room for more volatility, he said.