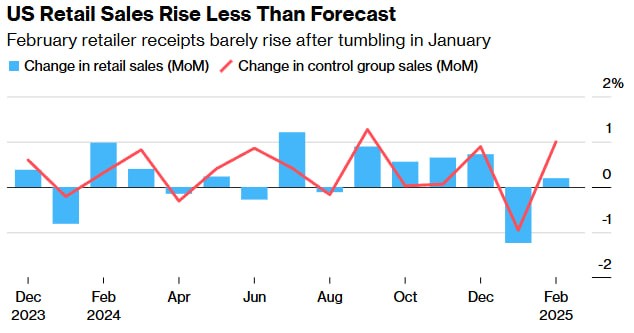

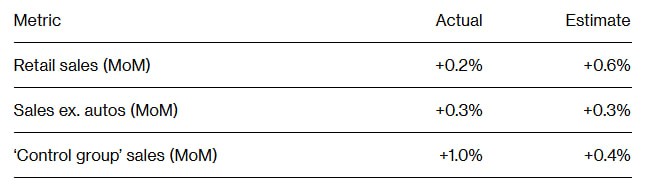

Disappointing retail sales last month added to concerns of a pullback in consumer spending in the US, while a pair of business surveys suggested growing caution.

Retail sales rose by less than forecast in February and the prior month was revised down to mark the biggest drop since July 2021. Combined with separate data Monday showing a dropoff in New York state manufacturing activity and weaker homebuilder sentiment, the reports are consistent with expectations for slower economic growth.

“The risk of much weaker growth, as consumers seek to rebuild a savings buffer in response to concerns about job security, now looks elevated,” Samuel Tombs, chief US economist at Pantheon Macroeconomics, said after the retail report.

The figures point to weak spending on goods, although there’s no sign of a severe pullback. Companies, investors and economists are cautious on the outlook as consumer sentiment sours and signs of financial stress mount amid risks of escalating trade wars sparked by President Donald Trump.

Low-income consumers are already strapped for cash, and wealthier Americans may also pull back as a recent stock-market selloff discourages big investments.

A rebound in e-commerce activity supported so-called control-group sales, an input into the government’s calculation of goods spending for gross domestic product. That measure — which excludes food services, auto dealers, building materials stores and gasoline stations — increased 1% in February, reversing the prior month’s drop.

While that will be helpful for first-quarter GDP, the jump was largely due to seasonal adjustment issues, according to Omair Sharif, president of Inflation Insights LLC. And other economists were quick to point out that the outlook is more concerning as recent measures of consumer and business sentiment have turned more negative.

“This report says a contraction of GDP in Q1 is more likely,” Carl Weinberg and Mary Chen of High Frequency Economics said in a note. “At a minimum, a decline in the growth rate of GDP is all but assured.”

Seven of the retail report’s 13 categories posted decreases, notably motor vehicles — which were expected to rebound from a weak January. Gasoline sales, as well as those of electronics and apparel were also lower. Spending at restaurants and bars, the only service-sector category in the retail report, declined by the most in a year.

The S&P 500 was higher as of 10:18 a.m. in New York, shortly after a report showed confidence among US homebuilders slid this month to the lowest level since August. In the New York state manufacturing data, factory activity dropped in March to the lowest level since early 2024 while measures of prices picked up.

Reconciling growth concerns, while also assuring investors the economy remains on solid footing, will be a key challenge for Federal Reserve Chair Jerome Powell this week. He’s due to speak at the conclusion of the central bank’s meeting Wednesday, in which policymakers are expected to hold interest rates steady.

Retailers including Target Corp. and Best Buy Co. have said they may have to raise prices because of Trump’s tariffs, whiles weak outlooks from companies like Kohl’s Corp. and Dick’s Sporting Goods Inc. are casting doubt about the strength of US consumers.

The retail sales figures aren’t adjusted for inflation and largely reflect purchases of goods, which comprise a relatively narrow share of overall consumer outlays. February data on inflation-adjusted goods and services spending will be released later this month.